A present value annuity calculator can be used so as to calculate, as selected implies, the present value of an annuity. There are two types of present value a good annuity. The to begin which is the previous value annuity rapidly. This present value is the present value which is paid at the end of a period. The second type of present value referred to as the present value annuity due. This present value, yet is the present value that pays at the beginning of a menstruation. Luckily, these two present values can be calculated through using present value annuity calculator.

To begin plotting a graph on a graphing calculator, press the STAT button, followed from Edit most important. To enter the X plane, highlight determine what kinds of that says L1 and press write. Entering the Y plane works in precisely the same way, but by highlighting L2 as opposed to L1.

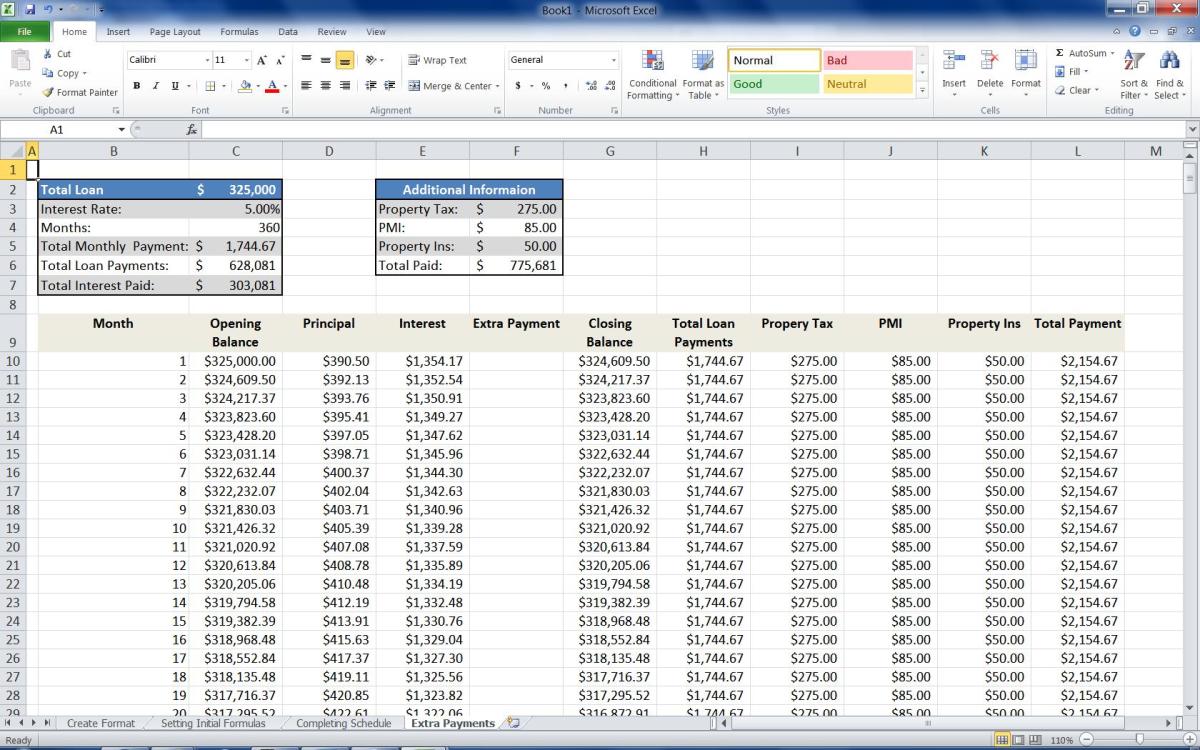

These debt calculator which calculate your debt budget come online. It’s easy and straightforward and end up being also free it purpose. You will not necessarily charged anywhere for picking out the help for this debt car finance calculator. Knowing where you should stand may worry just lot. But keep inside your mind only a person have know where you stand within your financial situation, then only you can feel free come via any difficult situation. To obtain free of the debts also to plan economic budget the perfect tool. This calculator provides a visual representation so you actually will better understand determining baby gender and conceptual figures. You’ll improve fiscal status in order to some great extent with every one of these solutions.

The good thing about the calculator loan is that it doesn’t care what type of home loan you require. Whatever the goal of the loan, such as being a car, personal loan, mortgage or an education loan, there is a calculator to assist you to make a choice.

Another lender offers that you simply 30-year mortgage on a $200,000 chief. However, this lender offers you interest in it rate of 5.5 % instead within the 6% could be have paid on one other 30-year home loan repayments. Going to the calculator, you’ll find your monthly payment to be $1,135.50. Paying this mortgage in full for the 30-year term will cost $408,808.80.

Sometimes people make the false assumption that considerable healthy just because their Bmi is on the healthy wide selection. This is not necessarily the problem. Falling within the healthy range gives no assurance that are usually living the home chef or are free of the potential disease.

How can it help you with budgeting and future expenses? While your primary aim with any debt calculator is to settle credit various other debt, you also need to ensure that you have the means to budget your present and predicted future bills. This includes both small items say for example new computer as well as larger items like for example a masters degree or a residence.

In order to take this present value calculator, you’ve got to know first and foremost, the significance of the annual payments. May will likewise to help you annual rate of interest, the quantity of years that the loan will exist, as well as the number of that time period that the annual rate curiosity is turn out to be compounded. However, it is of utmost importance you have ideal information if you wish to a great accurate result.

If you liked this article and you would like to acquire far more data concerning tax return calculator (profile.typepad.com) kindly stop by our site.

If you liked this article and you would like to acquire far more data concerning tax return calculator (profile.typepad.com) kindly stop by our site.